Halo traders! Hari ini aku mau sharing gimana cara memulai trading forex? Banyak yang tanya untuk bisa trading forex mulai dari mana? Yap, dari mulai daftar akun trading di broker forex. Ikuti panduan artikel ini untuk daftar di broker forex terbaik Indonesia bahkan dunia!

Memilih broker forex terbaik

Langkah paling awal yang harus dilakukan untuk menjadi trader forex adalah mendaftar di sebuah broker forex sebab kita tidak bisa langsung terhubung ke market forex tanpa perantara broker. Lalu apa rekomendasi broker terbaik untuk trader Indonesia?

Rekomendasi broker forex terbaik terpercaya di Indonesia

Ini bukan konten endorse, tetapu pure dari kepuasan aku menggunakan broker Exness. Aku udah bertahun - tahun menjadi user Exness dan so far sangat puas dengan semua layanan yang diberikan oleh Exness.

Jadi untuk rekomendasi broker forex terbaik terpercaya untuk trader Indonesia bahkan dunia aku menyarankan kalian untuk daftar di Exness aja.

Kenapa Exness?

- Depo WD instan 24/7 | 0 fee

- Unlimited leverage. Modal cekak bisa trading pakai lot gaban

- Low spread and commission (boleh di adu)

- Eksekusi cepat

- Akun trading bisa pakai berbagai mata uang lokal termasuk rupiah

- Swap free semua akun

- Multi assets (Forex, logam, energi, saham, crypto)

- Teregulasi di banyak badan keuangan dunia : FSCA, FCA, CySEC, FCA, FBCS, FSC mauritius, FSC BVI

- Banyak program exclusive utk trader. Exness adalah broker yang loyal sekali kepada para usernya. Sering kasih hadiah secara tiba - tiba. Hadiah paling berkesan yang pernah aku dapat dari Exness adalah jalan - jalan ke luar negeri beberapa kali. Gas yuk daftar biar dapat reward - reward eksklusifnya juga.

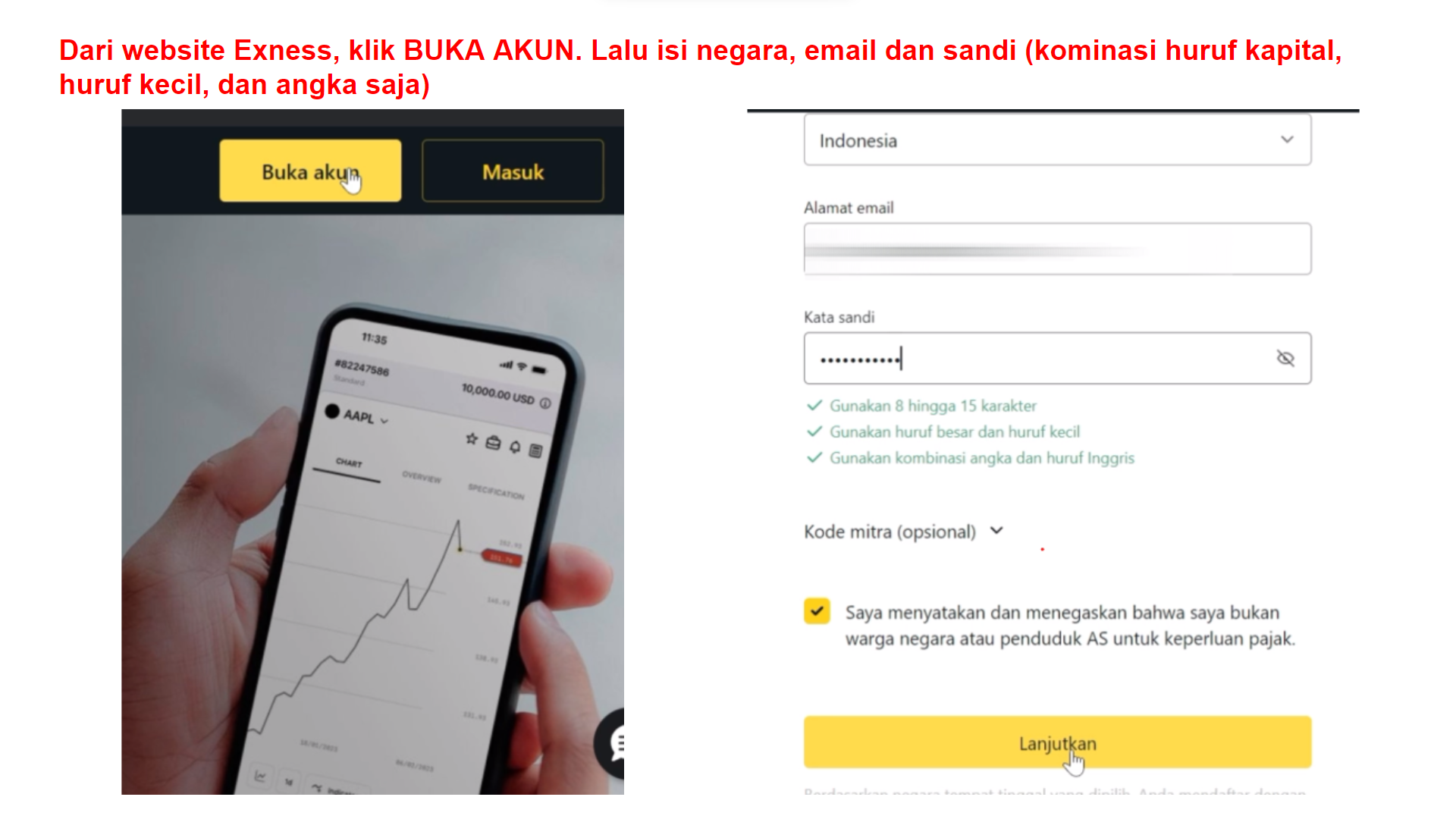

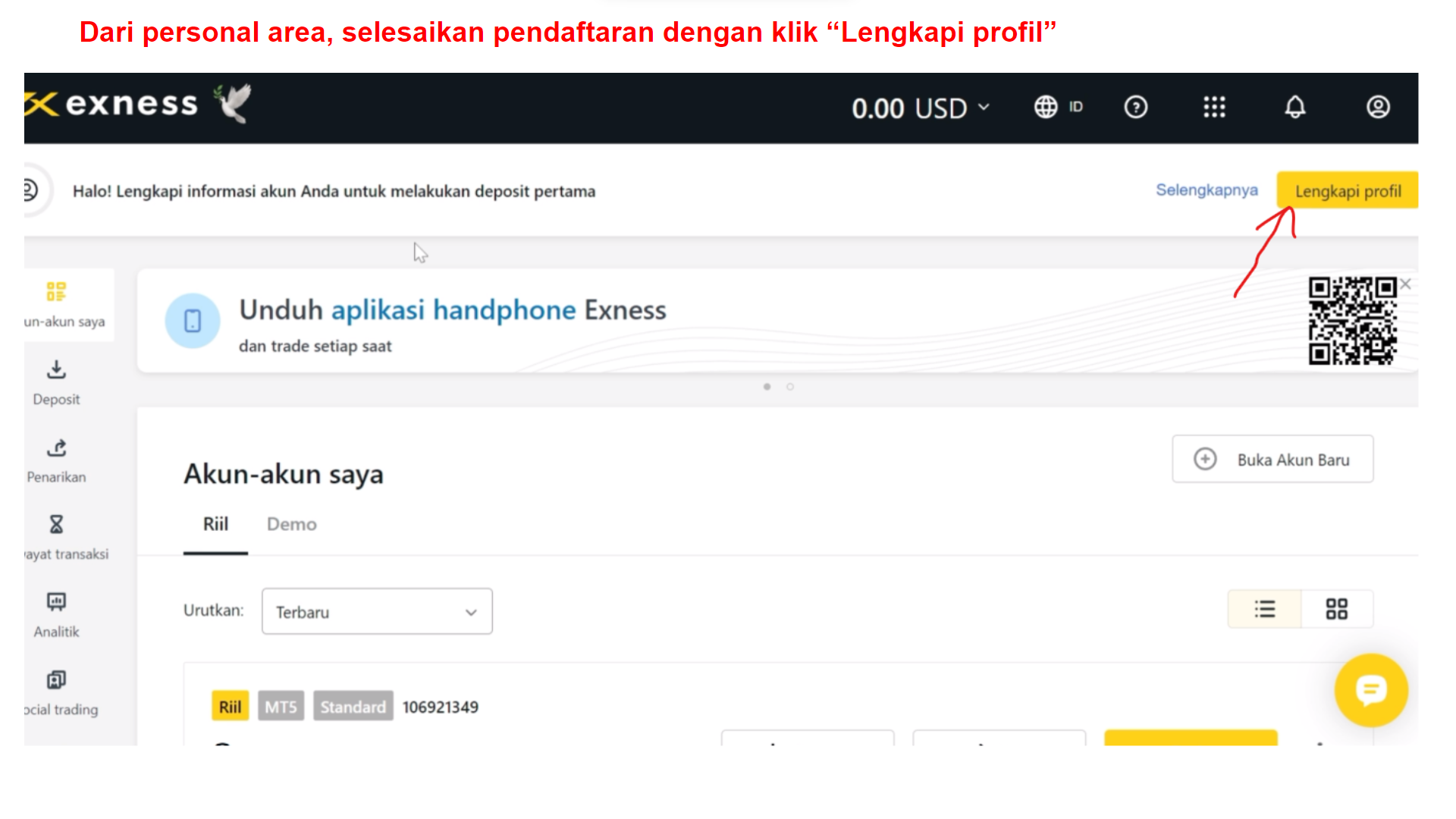

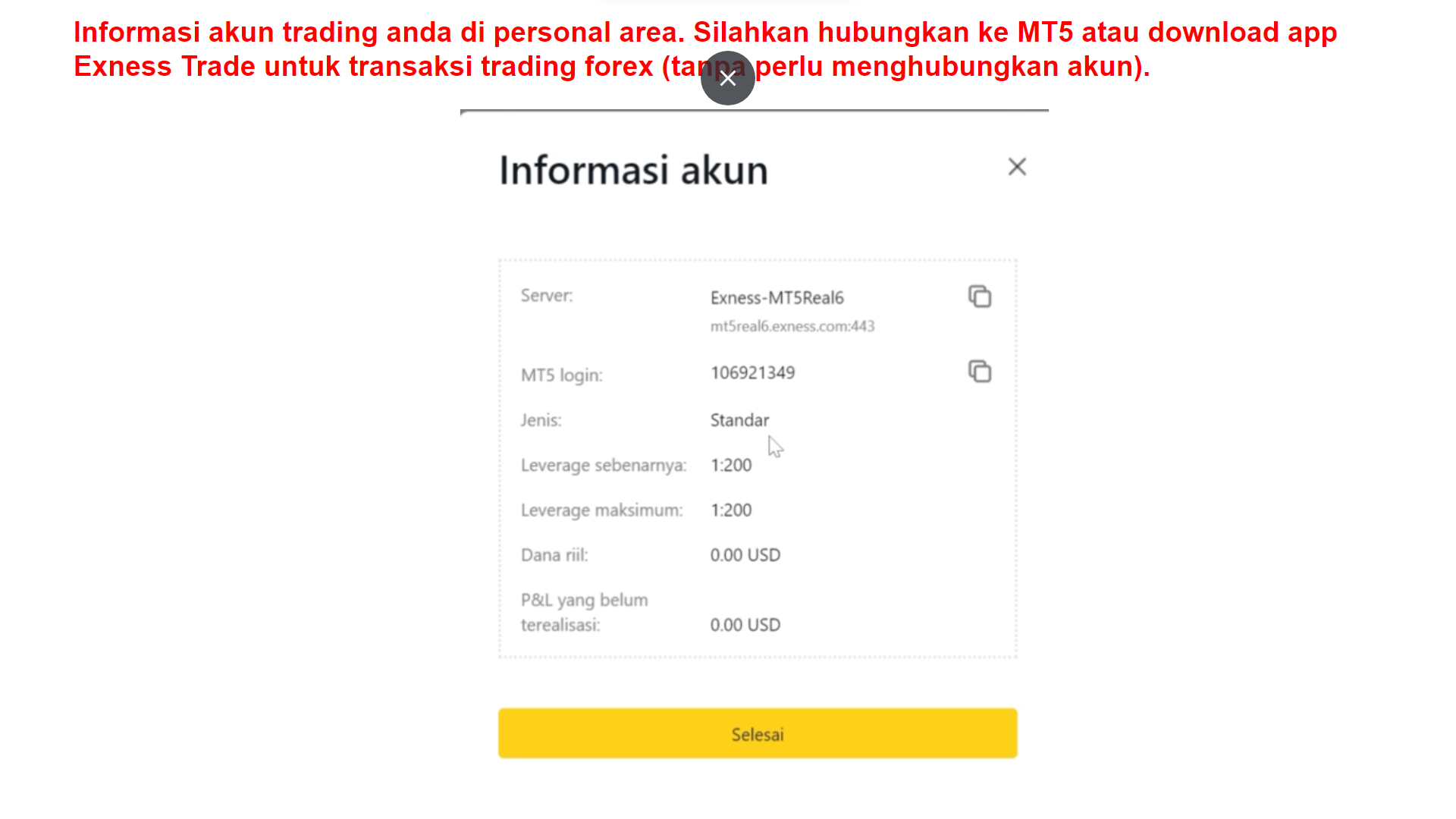

Cara daftar akun trading di Exness

Paling pertama silahkan klik link berikut untuk terhubung ke website resmi Exness lalu ikuti panduan langkah - langkah daftarnya :

>>> WEBSITE RESMI EXNESS <<<

Cara Daftar EXNESS :

trading forex mulai dari mana

cara memulai trading forex

cara daftar exness indonesia

cara memulai trading forex untuk pemula

cara daftar akun exness

cara trading forex

memulai trading forex

7 langkah memulai trading forex

cara daftar akun demo exness

memulai bisnis trading forex

cara trading forex

cara daftar broker exness

memilih broker forex

cara memilih broker forex yang baik

memilih broker forex baik

cara daftar forex

broker forex terbaik

cara daftar forex trading

broker forex terbaik 2023

cara daftar forex metatrader 4

cara daftar forex malaysia

cara daftar forex mt4

daftar broker exness

cara daftar main forex

rekomendasi broker forex

broker forex terbaik di indonesia

rekomendasi broker forex indonesia

broker forex terbesar di dunia

rekomendasi broker forex untuk pemula

cara trading forex di hp

rekomendasi broker forex terpercaya

broker forex terpercaya di indonesia

rekomendasi broker forex terbaik

cara trading forex di laptop

broker forex terbaik deposit kecil

rekomendasi broker forex trading forex

cara mendaftar forex

daftar broker forex penipu

cara trading forex scalper

broker forex terbaik di dunia

daftar broker forex

cara trading forex di olymp trade

broker forex terbaik di indonesia 2023

cara trading forex pemula

daftar broker forex legal di indonesia

cara trading forex tanpa modal

daftar broker forex terbaik

daftar broker indonesia

cara mendaftarkan forex

cara trading forex di mifx

cara trading forex yang benar

cara daftar exness

cara trading forex syariah

broker forex terbesar di indonesia